Care costs: The 'most tax efficient way’ of saving money to pay for care revealed

Care is something which can be essential, but it is often expensive. While many people may not be able to save for the prospect of needing care due to other outgoings to focus on, others may opt to set aside some money just in case it’s needed for later on in life.

Those who make savings for this purpose during their working lives may wonder whether there’s a way to do so “tax-efficiently”.

Speaking to Express.co.uk, Ian Jacobs, Partner at MHA MacIntyre Hudson, has shared his expertise on the topic.

He said: “The most tax efficient way of saving money for care is through making pension contributions.

“However with current annuity rates being well below five percent, it is difficult to see sufficient funds being built up within an individual’s fund to provide an income to cover all the care fees.

READ MORE: State pension age? You may be able to get extra £4,500 – who can claim and how in full

“Lump sums can be drawn down from a pension fund which obviously gives a finite life to the fund, which may run out at some point depending on the size of fund at the outset and the timescale involved.”

As such, it may be that a person will need to look to other forms of their finances in order to pay for care.

Mr Jacobs continued: “In many cases the main residence therefore becomes the source of funds for the care provision. Depending on the level of care and the timescale involved it may be inevitable for the house to be sold to generate the required funds.

“The disposal of the main residence is in most cases a tax free transaction, which is good news.

DON’T MISS

“It is worth noting that some providers are prepared to accept having a charge over the property, in lieu of regular monthly fees, to allow for a reasonable marketing period for the property, to avoid families having to take a lower offer when the pressure is on.”

Mr Jacobs also shared some expert insight into whether there was a way in which a person can pay for care tax-efficiently when they are in care.

“There isn’t anything within the tax legislation currently which affords tax relief for care home provision directly,” he explained.

“As previously mentioned taking the pension route is an option and presumably the Government see this as the obvious route for saving and try to encourage everyone to build up their pensions.

“Whilst not being necessarily tax efficient, one option I have encountered is the former matrimonial home being converted to multi-occupancy living (HMO) to obtain a regular income from the asset to pay for the care provision.

“How this is dealt with from a tax perspective will depend on individual circumstances, but this is no doubt an option.

“One of the benefits of this is that the asset value remains (to an extent) to be passed on after death.”

Elsewhere, some people who have reached state pension age may be able to receive financial support in order to help them to cover extra costs they may face due to a disability.

You may be interested

Sean Connery World War 2 films ranked and John Wayne's The Longest Day isn’t No 1

admin - Mar 11, 2025[ad_1] Sir Sean Connery's World War 2 films ranked according to film fans on IMDb and John Wayne's The Longest…

Opus review: Ayo Edebiri shines but half-baked cult thriller fails to indoctrinate

admin - Mar 11, 2025[ad_1] Ayo Edebiri is one of the only highlights of this derivative and unsatisfying cult thriller. [ad_2] Source link

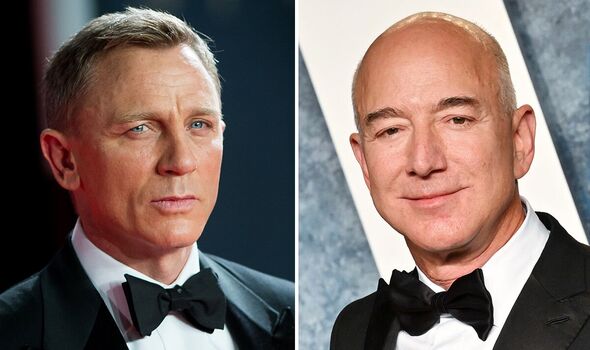

Next James Bond Amazon memo leak unveils Jeff Bezos’ plans for casting new 007

admin - Mar 11, 2025[ad_1] The next James Bond is in the hands of Amazon and a new memo leak discloses Jeff Bezos' 007…

Leave a Comment

You must be logged in to post a comment.