FINANCIAL CRASH WARNING: China’s debt could cause economic disaster ‘worse than 2008’

The colossal country has seen its GDP to debt ratio soar to eye-watering levels, from 148 per cent at the end of 2007 to around 277 per cent at the end of 2016.

Fears over China’s slowing economy triggered a huge stock market crash in 2015 and again at the start of last year.

However, policymakers managed to ease fears with actions to prop up markets and the economy.

At the end of last year, the Asian economy was growing by a bumper 6.8 per cent.

But the expansion is being fuelled by spiralling debts.

And its feared the economy could start to slowdown in the coming months, as actions by officials begins to fade.

Sky-high debt combined with a slowing economy is a toxic mix, experts have warned.

Sheridan Admans, investment research manager at The Share Centre, said: “China’s continues to pile on the debt at a worrying rate.

“The only comfort at this time is that it is internal rather than external debt.

“China has been working on ways to tackle this problem but such a sharp increase combined with the delays in coping with debt mountains, have previously been the cause of financial crises the world over.”

Credit in China is now approaching a historic crisis level, according to Anthony Doyle, investment director in the M&G Fixed Interest team.

He said: “The problem with heavily indebted economies is that the financial cycle could peak at any time.

“At some point, borrowers like households and corporations will conclude that their income is not sufficient to service their debt obligations.

“This will see the non-financial corporate sector enter into a deleveraging cycle: as has happened previously in Japan, Spain, and the US.

“As we are now nine years into the expansionary phase of the global economic growth cycle, and developed economies are still characterised by rock-bottom central bank rates, one has to wonder whether the next global recession will be much longer than the experience of 2008-09.”

The risks to China could be grow this year, thanks to Donald Trump, who has previously spoken out against trade policies

It’s feared the US president could slap trade tariffs on imports, which would heavily hit China’s economy.

Another risk is the US raising interest rates, which could speed up the amount of money flowing out of China.

Mr Admans added: “A key risk to the Chinese economy in 2017 is the US FED raising interest rates as this will likely lead to an increase in the pace of outflows from China.

“Furthermore, the region’s exports could come under pressure if the new US president Donald Trump initiates protectionist measures. Indeed, the devaluation of the Chinese currency against the dollar, and China burning through reserves to support it, could contribute to a rise in interbank rates.”

Capital Economics has also issued a warning over China.

In a note to investors it said: “We expect China’s growth to peak early in 2017.

“Thereafter, the key question will not be whether China faces an imminent hard landing but whether the leadership embraces the structural reforms needed to prevent trend growth from continuing to grind lower.”

At the moment, however, investors are not too panicked by the risks.

But it’s feared this could change at short notice.

Matthew Dobbs, fund manager for Asian Equities at Schroders, said: “Longer-term, the issue of rising debt to GDP and burgeoning non-performing assets in the system will have to be addressed, along with a recognition that the growth potential of China is materially lower than the six to seven per cent cited by Beijing.

“Clearly there are risks as to the timing of that realisation, and a potentially hostile geo-political and trade environment does not help, although US exports are less than five per cent of China’s GDP. “

You may be interested

'Most disturbing film ever' is little-known 1990s film with 83% rating now on Prime

admin - Apr 03, 2025[ad_1] This tale of vengeance reportedly disturbed one film director so much he threw the disc out of the window…

Beatles fans 'refuse to watch' upcoming biopic starring Barry Keoghan for one reason

admin - Apr 02, 2025[ad_1] The four-part biopic will see the story of the Beatles told from each band members' perspective as it stars…

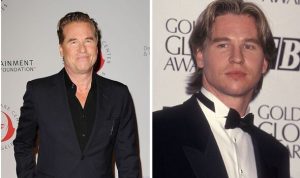

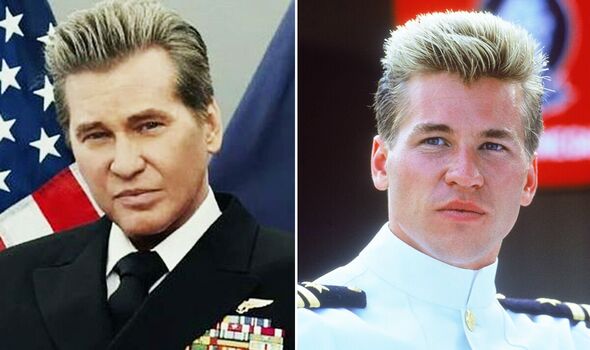

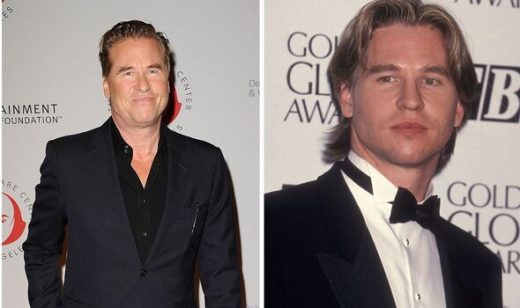

Val Kilmer's on-set feud with Hollywood star that led to box office bomb

admin - Apr 02, 2025[ad_1] Val Kilmer signed up for the ill-fated 1996 version of The Island of Dr Moreau, which later became a…

Leave a Comment

You must be logged in to post a comment.