Intercontinental Hotel Group flying despite lack of capital – SHARE HUNTER

The group has added another 10,500 rooms in the past six months, across brands that range from the luxury InterContinental to Holiday Inn Express in the budget category.

With 229,500 rooms in the pipeline, in a few years’ time, the people of Southampton will be able to squeeze in, too.

However, what makes IHG unusual is that it doesn’t actually “own” many of those hotels.

Instead, it either manages the hotel on behalf of landlords, or franchises out a brand to the hotel owner, directing reservations through online bookings.

In both cases, IHG collects revenues without actually owning the properties.

That model helped the group turn a 2 per cent uptick in revenue in the last half into an 8 per cent increase in operating profits and 10 per cent dividend growth, with additional revenue dropping straight through to profit.

This has fuelled steady dividend growth and the shares currently offer a yield of 2.1 per cent.

Analysts expect steady growth from here.

Unfortunately, it’s not all plain sailing, as revenue per available room, or RevPAR as it’s called in the hotel industry, suffered during the second quarter, due to a struggle in the US market as a result of oil prices taking a downwards turn.

The Americas accounted for 87 per cent of recent operating profits, so sluggish growth isn’t ideal, but Emerging Markets offer long-term growth.

Some 30 per cent of new business is in China, and IHG is spreading out from the largest cities to regional towns, where trading has been robust.

The group has even launched a specialist luxury hotel brand specifically for the Chinese market.

It is this roll-out that makes us fairly relaxed about the trading at IHG. The plans for new hotel rooms should support revenue growth, even if RevPAR slows.

The business model, which is light on capital, reduces risk involved in expansion and reassures that IHG can sustain its track record of raising or maintaining the ordinary dividend every year since 2004.

“This article is designed for investors who make their own decisions without advice, if unsure whether an investment is right for you, you should seek advice. Shares can rise and fall in value so you could get back less than you invest.”

You may be interested

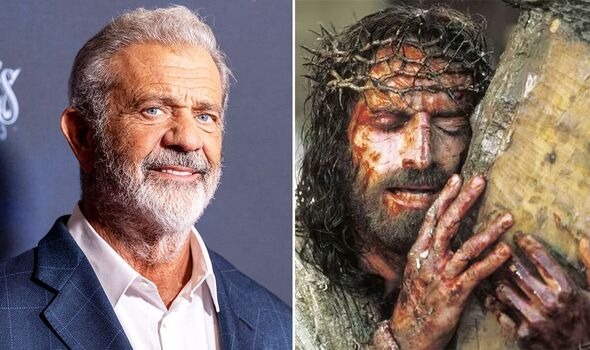

Three epic World War 2 films are on TV this weekend and they couldn’t be more different

admin - Jan 10, 2025[ad_1] Three classic World War 2 films on the BBC and ITV this weekend and they couldn't be more different.…

Top 10 James Stewart movies ranked and Rear Window missed out on No 1

admin - Jan 10, 2025[ad_1] The Top 10 James Stewart movies have been ranked by fans on IMDb and Rear Window missed out on…

Meet the millionaire who shut down Wonga – 'the UK's big banks all hate me'

admin - Jan 10, 2025[ad_1] When Dave Fishwick launched Britain's first community bank for 120 years, he inspired a smash hit Netflix movie. Now…

Leave a Comment

You must be logged in to post a comment.